Creating online courses is a global trend that allows you to make money in any country in the world. But, each individual country is a complex combination of linguistic, cultural and technical peculiarities that you need to know if you are going to launch a course.

For example, for English-speaking countries - there is already a huge amount of material on any topic and in high quality. You can study Figma or attend a Gordon Ramsay workshop for $100 if you speak English and have a foreign card or PayPal to pay.

There are not many courses created in the Russian-speaking market compared to the U.S., but the competition between the authors may be even higher. To sell your course - you need either a free niche with demand (for example, the Russian-language course on ChatGPT, released a few months ago) or a large, loyal audience.

And yet, there are still markets where there is high demand and almost no supply. For example, in Indonesia or Georgia, it's easy to launch courses even in IT professions, and in the most competitive market in the U.S., you can successfully sell courses in narrow niches.

What do you need to start selling in the US, Europe, or more exotic locations? What are the problems that authors face, and what can be foreseen in advance to make a successful course launch? I will try to answer these questions! 🙂

The main problem: accepting payments

Imagine you decide to sell a course or guide for the Serbian, German, or Azerbaijani markets. You could write the course material in your native language and find a co-author or freelancer to localize it for the local market.

Audiences will decide for themselves whether they are willing to pay for your knowledge, regardless of the format. The most important thing is that your product solves the user's problem and closes their need.

Once the information product is created, the other aspects become a matter of technology.

You choose a platform to host the course or develop your own, find a contractor who will be responsible for advertising and selling the course: it's no different from a regular business.

The main problem that authors face at the final stage is accepting payments from different countries and from hundreds of different issuers. It is very important to offer maximum freedom in choosing payment methods, to introduce installments (especially for expensive courses) and at the same time not to give up to a third of the proceeds for payments and withdrawals.

Registering your own company

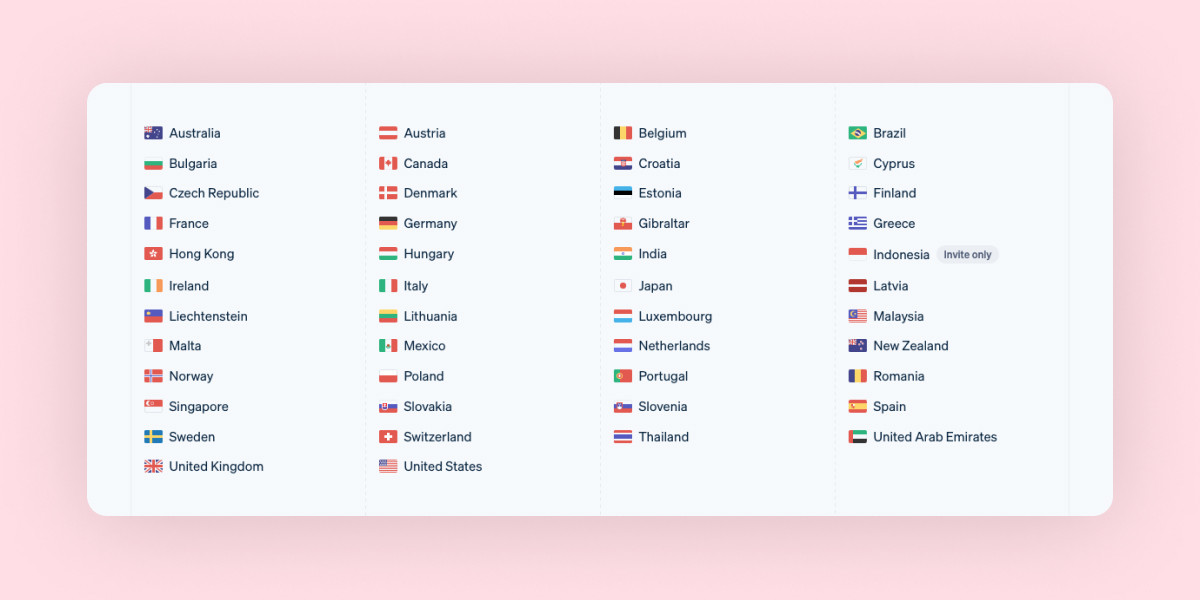

To accept international payments, you need an acquiring service and the best solution at the moment is Stripe. It supports most countries, payment methods, and extensions.

If you go to the Stripe website, you can easily find a list of countries where companies can accept payments with it.

To summarize, these are European countries, English-speaking countries (USA, Australia, NZ), and the Arab Emirates. In addition, Brazil and Hong Kong are also on the list, which can also be considered for incorporation.

In general, to incorporate Stripe, you will need:

-

Incorporation of a company in one of the permitted jurisdictions. At the moment, without a residence permit, Europe is practically closed to citizens of Russia and Belarus, and in the United States, there are significant restrictions due to sanctions.

-

Corporate bank account. As a rule, it is even more complicated than registering a company. You have to go through a KYC for you as the owner of the company and a check on the future operation of the business.

-

Personal overseas bank account, to withdraw profits. If you already have a residence permit in another country, most likely you already have an account in a suitable bank and the ability to accept SWIFT. If not, that's a separate task that will have to be solved

Let's look at several cases depending on the jurisdiction:

United States of America

Despite the rumors - there is no direct ban on registration of firms by citizens of Russia and Belarus. And yet, if you are not physically located in the U.S., you do not have a residence permit in Europe or other trust jurisdiction - remote registration of business becomes a very difficult task.

Even with the help of lawyers, you can not immediately register a new company, and in addition to registration, you will need to get an EIN and go through the procedure of opening a bank account. For example, Mercury Bank continues to open accounts with founders from Russia, but they do so much more reluctantly.

The cost of registering a company is more than $1,000. Taking into account the labour input required from your lawyer - the cost for a citizen of the Russian Federation or the Republic of Belarus is likely to be much higher.

In addition, you should not forget about the accounting and legal aspects of the state in which you are registering the company.

United Arab Emirates

In contrast to the U.S., Dubai continues to work with citizens of Russia and Belarus with relatively few restrictions. It is worth noting that it is also possible to open a bank account, but after you get an Emirates ID.

What is the procedure and its cost:

1. Registering a company in one of the Free Zones. Generally, activities outside the UAE are not subject to income tax or are subject to minimal taxes, which are not significant compared to Europe or the United States. The cost usually includes the cost of the Free Zone license (payable annually) and the Service Fees of the company responsible for registration. The minimum cost, in my experience, from 18000 AED (about $ 5,000).

2. Getting an Emirates ID. To open a bank account, you need residency status. You will have to come to Dubai, undergo a medical examination and submit documents. The cost of the service varies depending on the assisting company but also costs at least $2,000.

3. Opening of corporate and personal bank accounts. Depending on the bank and your advisor, the cost of this service will vary. You often find information that banks impose unexpected restrictions on the bank accounts of citizens of the Russian Federation and the Republic of Belarus.

At least $10,000 should be set aside for the full passage of stages, taking into account the cost of living in Dubai, one of the most expensive cities in the world.

Also, after that, you have to go through KYC when you connect Stripe, your site has to be ready to connect payments and that will take some time.

Stripe commission, in addition, to accept international payments is from 2.9% + 30 cents per transaction.

Alternative ways

When you launch your first online course abroad, you can't be sure that the costs of opening and maintaining it will pay off. After all, in addition to this you will need the cost of advertising, a sales department and maintenance of online courses.

Therefore, there are a significant number of services that allow you to connect acquiring without registering your own firm, and withdraw funds to the details that you have (even in Russia).

For owners of an online course, there are offers from Prodemus, Getcourse Pay, and other services. In addition, there are dozens of options for renting Stripe to accept payments, but hardly anyone can guarantee their safety.

At Meleton, we analyzed the main problems that online course authors have when receiving international payments and created Meleton Pay. Unlike our competitors, we offer the maximum number of countries (more than 200) to accept payments, and we are ready to connect PayPal to the acquiring service, which greatly improves conversion to payment in the American and European markets.

In addition, we provide free cards for authors to pay for business expenses, including advertising costs and subscriptions to services.

Any other options?

If you are launching a course for one particular country, for example, Armenia, the best option would be to register a local company and connect the acquiring within the country.

If you have a certain amount of revenue, it is more profitable to open your own foreign company, open an account, hire a lawyer and an accountant, and administer the acceptance of payments by yourself. For example, if you compare opening your own company in the UAE or using our service - the first option will be more profitable if the turnover of 2,000,000 dollars.

I'm sure the quality of the material and the ability to communicate its value to a wide audience is crucial to any course launch. But if you plan to sell to thousands of students a month: payment methods, payment conversion, and commission are definitely important factors that can make a course launch successful.